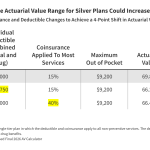

This brief looks at changes to Marketplace plans recently finalized by the Centers for Medicare and Medicaid Services (CMS) that may incentivize insurers to make their plans less generous. With less generous plans, consumers could face higher out-of-pocket costs, though those who don’t qualify for premium tax credits could see lower premiums.

Related Post

Health Provisions in the 2025 Federal Budget Reconciliation Law

On July 4, President Trump signed the budget reconciliation bill, previously known as the “One Big Beautiful Bill Act,” into law. This summary provides background,...

Implementation Dates for 2025 Budget Reconciliation Law

This searchable timeline shows the implementation date for the health care provisions included in the 2025 federal budget reconciliation law. previously known as "One Big...

KFF Health Tracking Poll: Public Finds Prior Authorization Process Difficult to Manage

Following a pledge by insurance companies to reduce the burden of prior authorizations, KFF's Health Tracking Poll examines the publics experience with the process. The...

Individual Market Insurers Requesting Largest Premium Increases in More Than 5 Years

This analysis of preliminary rate filings submitted by 105 ACA Marketplace insurers in 19 states and DC shows that ACA Marketplace insurers are requesting a...

ACA Preventive Services Are Back at the Supreme Court: Kennedy v. Braidwood

This brief provides an overview of the most recent ACA case under review at the Supreme Court (Kennedy v. Braidwood Management) and discusses the implications...

Explaining Litigation Challenging the ACA’s Preventive Services Requirements: Braidwood Management Inc. v. Becerra

This brief explains the preventive services coverage requirements, the basis of the Braidwood Management Inc. v. Becerra lawsuit, next steps in the litigation, and the...